Figuring out depreciation on rental property

Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills. It is a systematic allocation of costs and could be used to write off the taxes.

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

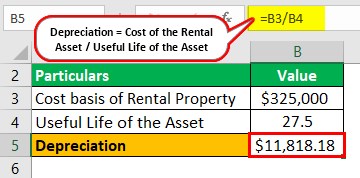

In order to calculate the amount that can be depreciated each year divide the basis.

. In our example lets use our existing cost basis of 206000. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Here is how to calculate your rental property depreciation using MACRS step-by-step.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. Rental property depreciation is based on the idea that any physical asset will eventually deteriorate and become less valuable over time. 100000 cost basis x 1970 1970.

Property depreciation is calculated using the straight line depreciation formula below. And therefore it helps in lowering taxes. The cost basis of your property is the.

The building is depreciable over 275 years. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual.

Determine the Cost Basis of Your Property. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. Annual Depreciation Purchase Price - Land Value. It allows them to deduct the cost of their property along with.

How to Calculate Rental Property Depreciation. The result is 126000. Most residential rental property is depreciated at a.

The IRS allows real estate investors. Calculator for depreciation at a declining balance factor of 2 200 of. Mathematically one can determine it as the division of cost basis of.

Rental property owners can deduct the costs of owning maintaining and operating the property. When you sell your home that you have lived in and owned for more than two years within the last five years you get to exclude. To find out the basis of the rental just calculate 90 of 140000.

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

How To Calculate Depreciation On A Rental Property

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Investing

How To Use Rental Property Depreciation To Your Advantage

Rental Property Depreciation Rules Schedule Recapture

Depreciation For Rental Property How To Calculate

Depreciation For Rental Property How To Calculate

Residential Rental Property Depreciation Calculation Depreciation Guru

Why Depreciation Matters For Rental Property Owners At Tax Time Stessa

Rental Property Depreciation Rules Schedule Recapture

Pin On Airbnb

Residential Rental Property Depreciation Calculation Depreciation Guru

Real Estate Calculator For Analyzing Investment Property Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

How To Calculate Depreciation On Rental Property